Bitcoin facing its fate: imminent rebound or more correction?

Bitcoin’s price has experienced notable volatility in recent months. At the time of writing, Bitcoin’s quotation stands around $94,683, generating a debate among traders about the probability of a “short squeeze” or an unexpected rally, versus the prospect of a pullback that could lead Bitcoin back towards the $87,000 zone. The price fluctuation between bullish and bearish movements is based on a series of key factors that influence market dynamics.

Bitcoin’s recent appreciation from its low of $76,000 is attributed to specific bullish catalysts that have favored its market capitalization. However, analysts at The Kobeissi Letter warn of the possibility that the current rally is a prelude to a correction towards $87,000, which demands caution from investors.

The market is now up over +1% on the day on no news at all.

As we have seen multiple times this year, it almost feels like someone is front-running something right now.

We expect to see some sort of bullish announcement soon. pic.twitter.com/MX1fpabT7e

— The Kobeissi Letter (@KobeissiLetter) April 24, 2025

It is a fundamental principle that the price of crypto assets responds to events and developments within the financial ecosystem. In the particular case of Bitcoin, the increase in demand from institutional investors and the capital inflows into spot Bitcoin exchange-traded funds (ETFs) in the United States exert a significant influence. Data provided by Farside Investors indicate a sustained increase in these flows since April 21st, which could signal a possible conclusion to the bearish phase. Another factor driving the price upward is the strategic accumulation of BTC by various institutions as a hedge against monetary inflation and prevailing macroeconomic uncertainty.

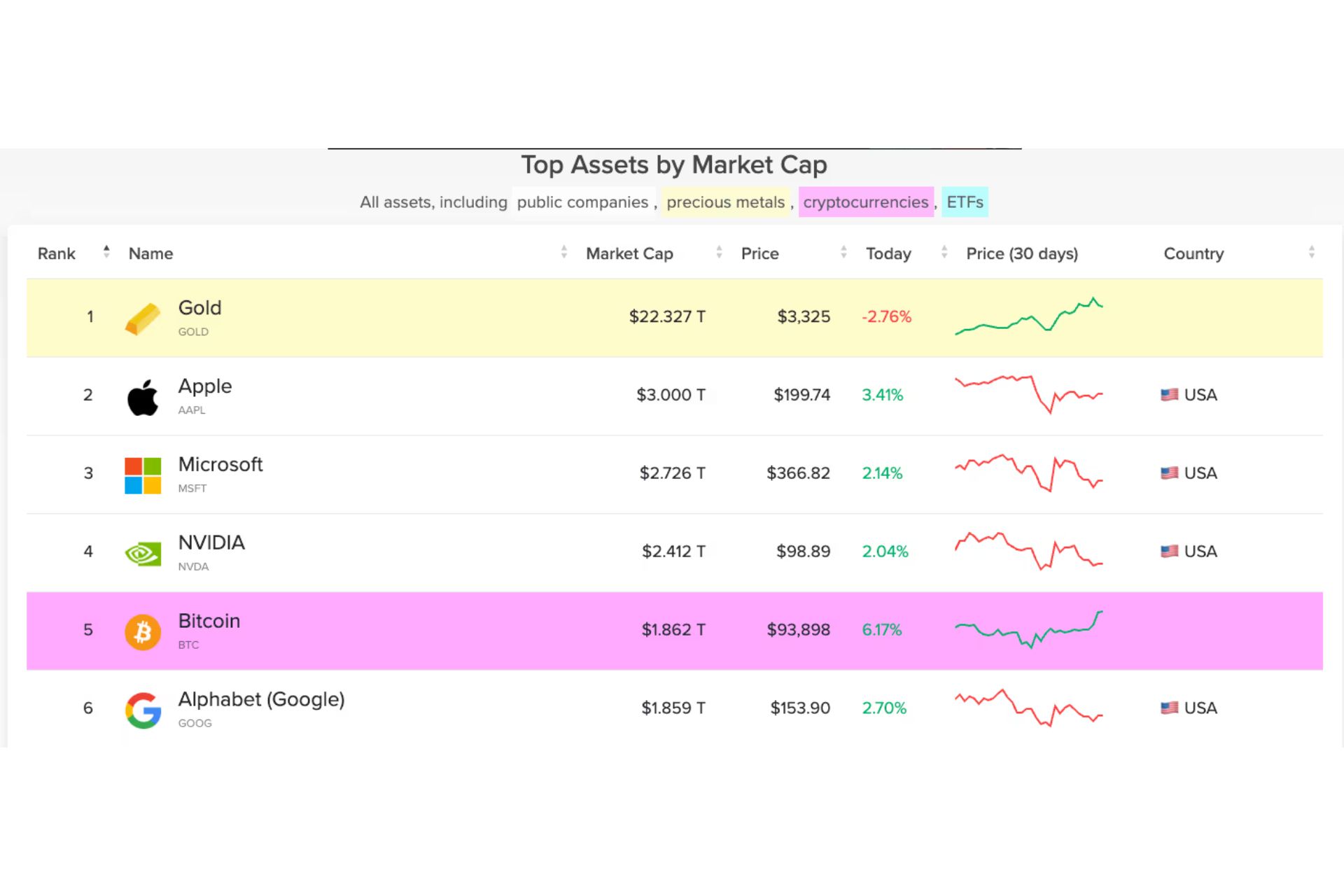

A highly significant event is Bitcoin’s consolidation as the fifth most valuable asset globally, surpassing entities like Google and silver, which illustrates the significant growth trajectory of the cryptocurrency since its inception.

The $94K–$95K zone is clearly the resistance to beat.

🔹A pullback to gain momentum seems like the next logical move, but how far?

The $89K–$90K zone could be next to test bulls, but with BTC’s structure strength, these dips are for buying.

Follow the move with us! pic.twitter.com/VbloG8KEzM

— Swissblock (@swissblock__) April 24, 2025

The last week has been decisive for Bitcoin, marking the surpassing of three significant resistance levels in a single weekly candle, as noted by Rekt Capital.

Bitcoin has repeated mid-2021 price history with a breakout from its range formed by the two Bull Market EMAs$BTC #Crypto #Bitcoin https://x.com/rektcapital/status/1901706135364567157 pic.twitter.com/B5qhLKso2z

— Rekt Capital (@rektcapital) April 28, 2025

In summary, the zone between $94,000 and $95,000 constitutes a crucial resistance to overcome, and there is a possibility that the price will retrace to evaluate lower support levels. Additionally, the key support level is around $93,500, being a primary target for traders anticipating a consolidation of the BTC/USD pair after its recent breakout.

Bitcoin at $94k, yet —

Google searches for “Bitcoin” near long term lows.

This hasn’t been retail driven. Institutions, advisors, corporates, and nations have come into the space.

The types of investors buying Bitcoin is expanding. pic.twitter.com/Gtdh5u0bm6

— Hunter Horsley (@HHorsley) April 27, 2025

Given these market dynamics, investors should consider the inherent dual nature of Bitcoin. This cryptocurrency is characterized by behaving both as a risk asset and a digital safe haven, depending on market conditions and investor sentiment. In periods of financial instability, Bitcoin tends to act as a safe-haven asset, similar to gold.

Furthermore, the growing confidence demonstrated by institutional investors in Bitcoin is a relevant factor, evidenced by the consistent inflow into spot Bitcoin exchange-traded funds (ETFs). However, it is crucial for investors to keep in mind the intrinsic volatility of the cryptocurrency market when making any investment decisions.