The Best Trading Books: A Guide by Levels (Technical Analysis, Psychology, and Risk Management)

Entering the world of financial markets can be overwhelming due to the sheer amount of information available. To move forward with a steady foot, it is essential to organize your learning by levels and clear objectives. Before starting, remember: trading involves a real risk of capital loss, and reading these books does not guarantee profitability; education is only the foundation of a long and disciplined process.

How to Choose a Trading Book (Without Wasting Time or Money)

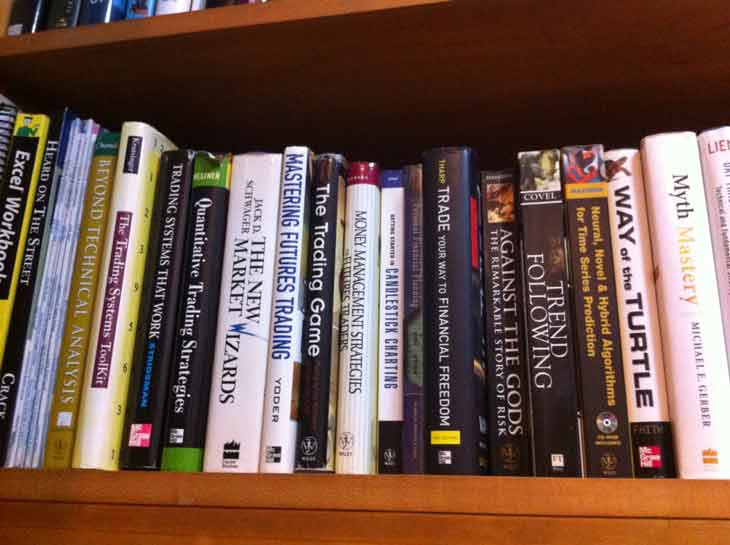

Not all books suit every profile. A common mistake is trying to read advanced manuals on quantitative systems when the fundamentals of price action are not yet understood.

Choose based on your level:

- Beginner: Look for texts that explain basic terminology, types of assets, and how the market auction works.

- Intermediate: Focus on deepening specific methodologies (such as volume or price action) and developing your own trading plan.

- Advanced: Prioritize books on applied statistics, algorithmic systems, and portfolio optimization.

Choose based on your goal:

Define which area you need to strengthen: if your charts are clear but your hands shake when entering a trade, you need psychology. If you win often but a single loss wipes out your profits, you need risk management.

Signs of a good book:

Stay away from titles that promise quick wealth or “secret formulas.” A quality book focuses on the process, probability management, and capital protection.

Trading Books for Beginners

To build a solid foundation, these titles are essential for understanding what happens behind the screen.

Market and Method Fundamentals

- “Trading for a Living” (Alexander Elder): A classic covering the three pillars: mind, method, and money. It teaches how to view the market as a psychological mass.

- Practical Tip: Use the “Triple Screen” system proposed by the author to filter your entries across different timeframes.

- “Trading for Dummies” (Ann C. Logue): Ideal for an overview without excessive technicalities, explaining everything from what a stock is to how to read financial news.

The First Layer of Risk Management

At this stage, the most important thing is learning how not to lose everything. It is vital to understand the concept of Stop-Loss and position sizing. Many beginners make the mistake of risking too much per trade; the golden rule is usually not to risk more than 1% or 2% of your total capital on a single idea. To manage these funds in a controlled manner, it is advisable to top up Bitsa and use an independent card for operating expenses and subscriptions to analysis tools.

Technical Analysis and Investment Methods (Charts, Patterns, and Indicators)

Technical analysis is based on the premise that price discounts all information and that history tends to repeat itself.

Chart Reading and Price Action

- “Technical Analysis of the Financial Markets” (John J. Murphy): Considered the “bible” of the industry. It exhaustively explains chart patterns (head-and-shoulders, triangles, flags) and Dow Theory.

- “The Wyckoff Method” (Enrique Díaz Valdecantos): Excellent for understanding professional manipulation and how “strong hands” accumulate or distribute assets.

Technical Indicators and When (Not) to Use Them

Indicators (RSI, MACD, Moving Averages) are mathematical calculations based on past price. They help filter information but do not predict the future. A chart with too many indicators often leads to “analysis paralysis.”

Platforms and Tools

To practice what you have learned, platforms like MetaTrader (MT4/MT5) or TradingView are commonly used. Before trading, many traders use the Bitsa virtual card to pay for real-time data plans on these platforms without compromising their main bank accounts.

Psychology and Mindset in Trading (What Usually Blows the Account)

Trading is 20% strategy and 80% psychology. Fear of failure, euphoria after a winning streak, or the desire for “revenge” after a loss are the true enemies.

Emotional Control and Biases

- “Trading in the Zone” (Mark Douglas): The definitive book on mindset. It teaches how to think in terms of probabilities and to accept that any individual trade has a random outcome.

- Common Biases: Confirmation bias (only seeing signals that support your idea) or FOMO (Fear Of Missing Out) often cause impulsive and disastrous entries.

Routine and Disciplined Systems

Discipline is built through habits. It is imperative to keep a trading journal where you record not only the entry and exit prices but also how you felt at that moment.

Money Management and Personal Finance

Capital protection is the absolute priority. According to the National Securities Market Commission (CNMV), most retail investors lose money due to a lack of proper risk management.

Simple Risk Management Rules

- Drawdown: Understanding how much capital you are willing to see decline before stopping.

- Correlation: Don’t buy 5 different cryptocurrencies if they all move the same way; that is not diversifying—it is multiplying the risk.

Trading and Personal Finance

Never trade with money you need for rent or food. Trading should be done with risk capital. To maintain this strict separation, you can buy Bitsa and assign a specific budget for your training expenses and tools, protecting your household economy.

Books for Advanced and Expert Traders (Quantitative and Systems)

- “Trade Your Way to Financial Freedom” (Van K. Tharp): Focuses on mathematical expectancy and how position sizing is more important than the entry point.

- Backtesting: The process of testing a strategy against past data to see if it would have been profitable. According to education portals like Investopedia, a solid backtest requires a large data sample to avoid curve-fitting.

Recommended Reading Itinerary (Practical Plan)

| Phase | Weeks | Recommended Readings | Practice |

| Beginner | 1-4 | Trading for a Living & Trading in the Zone | Set up a demo account and log every trade. |

| Intermediate | 5-12 | Technical Analysis of the Financial Markets & Trade Your Way to Financial Freedom | Master position sizing and chart patterns. |

Frequently Asked Questions (FAQ)

- Which book should I read first? Trading for a Living by Alexander Elder is the best-balanced starting point.

- Do these books work for Crypto? Yes, the principles of technical analysis and psychology are universal and apply to any market with liquidity.

- What is a backtest? It is simulating your strategy in the past to check its statistical viability before risking real money.

Conclusion

Your trading must be based on your own rules, but always under the umbrella of a proven method and controlled risk. Trading is not a path to quick wealth, but one of personal and statistical mastery.

Choose your first book today, draw up a reading plan, and start your education with sound judgment.