Javier Milei and the cryptocurrency Libra: a clear and transparent analysis

Javier Milei is an economist and the current president of Argentina. His background includes university teaching, research, and work as an economic analyst. Throughout his career, he has publicly expressed positions on various monetary and financial topics, including cryptocurrencies.

Milei has made statements about digital currencies and their potential role in economic systems. His remarks include references to cryptocurrencies as options within the financial landscape—a topic that sparks debate in highly volatile economies like Argentina’s.

In February 2025, Milei became involved in a controversial episode related to the cryptocurrency $LIBRA. The case triggered political reactions, judicial investigations, and a broad debate about responsibilities and crypto regulation.

The context: Javier Milei, economist and crypto-aware

The Argentine president has academic training in economics, holding bachelor’s and master’s degrees in the field.

Milei identifies with economic liberalism, specifically the Austrian School of Economics. This school advocates free currency competition and questions the state monopoly over money issuance. From this theoretical perspective, Milei has incorporated cryptocurrencies into his economic discourse.

As a political figure—especially since taking office in 2023—his comments on cryptocurrencies have drawn attention from the crypto community. Milei has argued that blockchain technologies offer possibilities for alternative financial systems, although his statements have varied in scope and specificity depending on the context.

What is the cryptocurrency Libra and why was it created?

The $LIBRA cryptocurrency was developed by KIP Protocol. The token was created on the Solana blockchain (a platform known for fast transactions) and was promoted as an instrument to connect investors with business projects in Argentina.

The project was marketed with the argument that Argentina has talented entrepreneurs and innovative ideas but lacks sufficient resources to bring them to life. $LIBRA presented itself as a solution to channel private investment directly into these Argentine business initiatives.

The initiative was presented as a private, independent project, with no direct ties to government entities, but aligned with free-market principles and economic growth.

Javier Milei and his relationship with $LIBRA

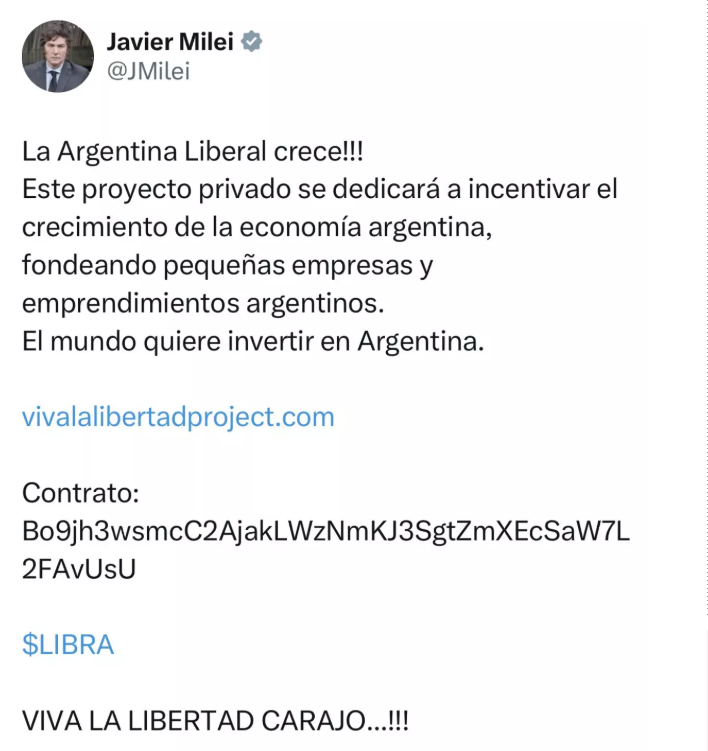

On February 14, 2025, at 7:01 p.m. (Argentina time), Javier Milei posted on his X account promoting the $LIBRA project as part of the “Viva la Libertad Project.” The message included links to the project’s website and the token’s contract address, and it was pinned to his profile.

Following the president’s post, the price of $LIBRA surged rapidly. According to market data, the capitalization reached approximately $4 billion within hours, with the token trading close to $5 per unit. Roughly 40,000 users bought the asset during this period.

Hours after the peak, $LIBRA fell below $1, a drop of over 90%. Milei deleted his original post and later stated that he was “not familiar with the details of the project” and had “decided not to continue giving it exposure.” He said he had “shared” but not “promoted” the project.

Hace unas horas publiqué un tweet, como tantas otras infinitas veces, apoyando un supuesto emprendimiento privado del que obviamente no tengo vinculación alguna.

No estaba interiorizado de los pormenores del proyecto y luego de haberme interiorizado decidí no seguir dándole…

— Javier Milei (@JMilei) February 15, 2025

KIP Protocol, the token’s developer, issued a statement clarifying that it was a private project and that Milei “was not and is not involved in any way in the development.” Julian Peh, CEO of KIP Protocol, had held prior meetings with Milei in October 2024 during the Tech Forum in Argentina.

Prior blockchain transaction analyses revealed that approximately 80% of the circulating supply was concentrated in a few wallets, enabling significant price moves. Specialized consultancies estimated that certain groups may have obtained around $107 million by selling during the price peak.

What do experts say? Diverse views on the $LIBRA case

What happened with $LIBRA sparked a range of interpretations among crypto experts, financial analysts, and the broader community.

From a technical standpoint, several blockchain analysts identified features consistent with market manipulation dynamics. Other analysts emphasized that extreme memecoin volatility is inherent to such assets and does not necessarily imply fraudulent intent.

Julián Colombo, Country Manager at Bitso Argentina, noted that “the vast majority of memecoins are projects that die shortly after being born,” and stressed the importance of researching token ownership before investing.

On the other hand, sectors aligned with Argentina’s government interpreted the situation as a political smear campaign. In subsequent interviews, Milei stated that those affected were “highly specialized investors” and “volatility operators” who understood the risks.

The international crypto community was divided. While some saw the episode as a textbook example of the risks of tokens with no backing and insufficient technical documentation, others debated the responsibility of public figures when mentioning speculative assets on their platforms. The case fueled discussions on regulation, transparency, and the need for financial education in the crypto ecosystem.

The $LIBRA case illustrates the complexity and risks of the cryptocurrency market—especially when tokens lack clear technical documentation and exhibit highly concentrated ownership. The events sparked a debate that goes beyond technicalities, touching on public responsibility, digital asset regulation, and financial education.

Ongoing judicial investigations in Argentina and other countries will determine whether there were legal irregularities in the launch and promotion of $LIBRA. Meanwhile, the episode serves as a reminder of the importance of due diligence before investing in any cryptoasset—particularly those lacking transparent information about how they work, the development team, and the token economics.