Best crypto prepaid cards without a bank account in 2026

What if you could pay at any store, withdraw cash from ATMs and shop online without having a traditional bank account? Crypto prepaid cards make this possible. You top up with cryptocurrencies or cash and use them like any regular Visa or Mastercard. No paycheck required, no bank paperwork, and no mandatory monthly fees.

This model is growing especially among young people, freelancers, digital nomads, and crypto users who need an agile alternative to the traditional banking system. In this guide, we’ll explain how they work and why Bitsa stands out as a complete option in 2026.

What is a crypto prepaid card without a bank account and how does it work?

A prepaid card works on a basic principle: you only spend the money you’ve previously loaded. Top up €100, you have €100 available. No overdrafts, no interest, no bank account behind it.

The crypto part transforms these cards into something special:

- Top up crypto from the app.

- It automatically converts from crypto to euros.

- Use it like any Visa/Mastercard.

Why don’t I need a bank account? They work independently of the traditional banking system. You don’t need a checking account, paycheck, credit history, or minimum balances. The prepaid card is your complete financial product, with total control from the app through instant blocking, real-time notifications, and quick top-ups.

Available types

There are different types of prepaid cards depending on your needs:

By format:

- Physical: Standard plastic card, works for physical stores and ATMs.

- Virtual: Managed from the app, ideal for online purchases. If your phone has contactless, you can also pay physically with Google Pay or Apple Pay.

- Without numbering: These are cards, both physical and online, that don’t have any data or numbering, making them more secure.

By functionality:

- Basic: Their only function is to store balance and let you spend it.

- With rewards: These cards give you back a percentage of each purchase.

- Privacy: These cards prioritize user privacy within the legal framework. They’re not “anonymous” (that’s illegal), but they minimize shared information.

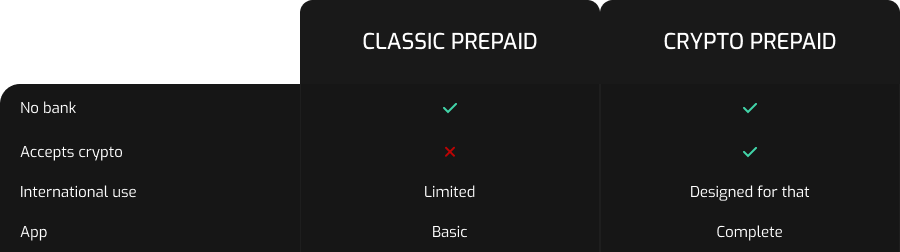

Comparison: traditional prepaid vs crypto

Traditional prepaid cards operate only with fiat and are especially useful for local use. Crypto prepaid cards accept both fiat and cryptocurrencies and have an international focus with advanced apps that act as a bridge between your digital holdings and the real economy.

The advantages are clear: financial freedom without banking permissions, absolute spending control making it difficult to get into debt, and barrier-free access without requiring a paycheck or credit history. Additionally, they offer more privacy than traditional banks within legal regulations.

Ideal profiles for crypto prepaid cards

- Young people and students: First steps without meeting banking requirements.

- Freelancers and nomads: Crypto/international payments, multiple countries.

- Crypto users: Digital holdings to real spending without friction.

- Unbanked: Alternative to the system that shut doors on them.

Bitsa: your crypto prepaid card

After analyzing the complete landscape, Bitsa stands out as an option that meets all criteria: you don’t need a bank account to create it, complete crypto support, transparent fees, and real international use.

Barrier-free opening

Opening is completely online and eliminates all barriers of the traditional banking system. You don’t need a prior bank account, paycheck, credit history, or to visit offices. Just your smartphone, valid ID, and 5-10 minutes for verification. This process is designed to be accessible.

Real flexibility: physical and virtual card

Bitsa offers both options, letting you choose as needed. The virtual card is available immediately after registering and passing KYC, free of charge. It’s perfect for online purchases, digital subscriptions like Netflix or Spotify, and compatible with Apple Pay and Google Pay.

The physical card is optional—request it only if you need payments in stores or ATMs. It operates with Visa, accepted at millions of merchants globally, and arrives by mail in days.

This flexibility lets you start with the free virtual card and decide later if you need the physical one.

Top up with your favorite payment method

This is where Bitsa really demonstrates its versatility. You can top up with Bitcoin, Ethereum, Tether, and other stablecoins through a process from the app with automatic conversion to euros. But it also accepts SEPA transfers if you have a bank account, cash at authorized points, or prepaid vouchers.

This versatility means you’re not tied to a single method. If you have crypto, use it. If you prefer cash or transfer, you can too. The choice is yours.

Intuitive app designed for real use

Bitsa’s mobile app balances complete functionality with ease of use. View balance and transactions in real time, top up in seconds with crypto or fiat, instantly block or unblock card, receive immediate push notifications of each transaction, check complete history with categorization, manage multiple cards, and export transactions for accounting and taxes.

The interface is clear and doesn’t require you to be a cryptocurrency expert. It’s designed for daily use, not for professional traders.

How to Convert Crypto to Euros

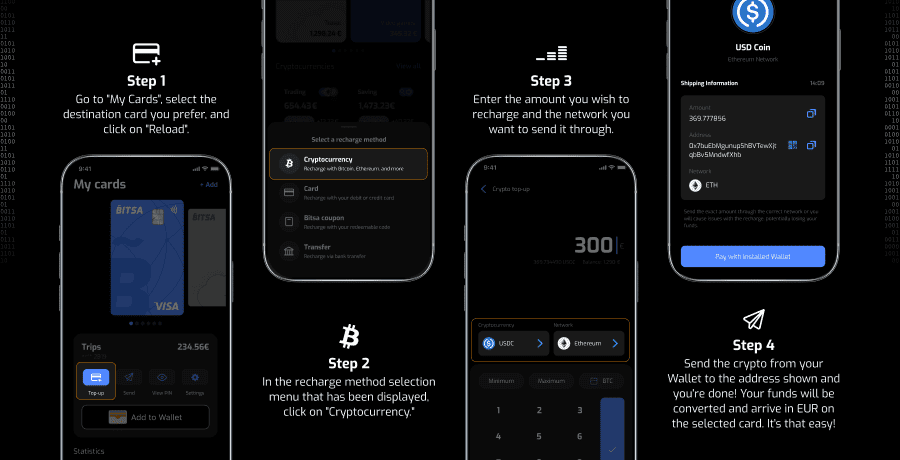

The process is very simple:

- Download the official app (iOS/Android)

- Register with email, phone, and basic data and complete KYC verification (ID + selfie)

- Choose your card: free virtual or physical

- Open the app and select “Top up card”

- Choose “Cryptocurrency” and select your crypto (BTC, ETH, USDT…)

- Enter the amount to send

- Bitsa converts to euros after blockchain confirmation

- Your euro balance is ready to spend. Use your card for online purchases, Apple/Google Pay, stores, and ATMs

Crypto prepaid cards without a bank account are a real alternative to the traditional banking system in 2026. It’s the tool needed by students, freelancers, crypto users, and anyone who values freedom over institutional dependence.

Get your Bitsa card and start using your cryptocurrencies anywhere.