How to convert bitcoin to euros and spend it

You’ve got Bitcoin in your wallet or on an exchange, you watch its value go up and down, but when it comes time to pay for groceries or fill up your car, you’re not quite sure how to go from “I have BTC” to “I can buy things.” You’re not alone.

In this guide, we’ll look at the main ways to convert Bitcoin to euros and how you can spend it in your daily life. We’ll also see how crypto prepaid cards (like Bitsa) work so you can go from having BTC on a screen to paying at any store just like a regular card.

What converting bitcoin to euros means

Converting Bitcoin to euros means going from a digital asset whose price changes every minute to a stable fiat currency (the euro) that you can use in the real world: paying in stores, withdrawing cash from ATMs, or transferring to another person…

BTC lives on the blockchain. The euro, in your bank account or on your card. When you convert, you’re basically selling your Bitcoin and receiving euros in exchange at that moment’s exchange rate. Almost always when you convert crypto to euros, you’ll pay something: exchange fee, withdrawal fee, service fee, blockchain network fee… fees vary depending on the method you use. Times do too—some options are instant, others take hours or days.

And then there’s the tax side. In many countries, converting Bitcoin to euros is considered a capital gain if you’ve had profits. You should check your country’s regulations or consult with a professional if you’re moving significant amounts.

Main ways to convert bitcoin to euros in 2026

In 2026, there’s no longer a single “right way” to go from BTC to euros. What you have is a trade-off between speed, fees, privacy, convenience, and whether you want (or not) to bring your bank into the equation.

Centralized exchanges

You send your BTC to an exchange, sell BTC for EUR, and then withdraw those euros to your bank account.

Pros:

- High liquidity, you can sell quickly

- Many trading pairs available

- Familiar interface

Cons:

- You need a bank account

- You have to go through KYC (identity) verification

- Withdrawals can take several business days

- You depend on the bank accepting the transfer

It’s a useful flow if you already have a bank account and don’t mind waiting a bit.

P2P platforms and direct sales to other people

You can also sell your BTC directly to another person using P2P platforms. You send BTC, the other person pays you in euros by bank transfer, payment app, PayPal, whatever you agree on.

The process is usually more manual and requires trusting the platform to mediate the operation. It’s not for everyone, but it can be quick if you find a buyer. Make sure to use platforms with escrow systems to avoid scams.

Bitcoin ATMs

BTC ATMs let you scan a QR code, send Bitcoin, and receive euros in cash on the spot.

It’s quick and direct, but it also has its downsides:

- Fees are usually high (5-10% or more)

- There are quantity limits

- There aren’t that many ATMs around

If you need cash now and have one nearby, it can work. But it’s not the most economical method.

Crypto prepaid cards: convert and spend in one tool

This is where solutions like Bitsa come in. The concept is simple: you top up the card with BTC or other cryptocurrencies, it automatically converts to euros, and you can spend that balance directly with the card at any store. You don’t need to go through a bank or make withdrawals—everything stays in the app and you can pay like with any card.

Ways to pay with cryptocurrencies (with and without Converting to Euros)

Here comes the important part: paying with crypto doesn’t always mean the same thing. There are different ways to pay with BTC, and you should look for the one that best suits your needs.

Direct payment at stores that accept crypto

Some stores (especially online, but also physical ones) accept direct Bitcoin payments. In these cases, you pay from a platform or service that allows sending BTC directly to the merchant. The problem is that these types of stores are in the minority. The vast majority only accept euros. That’s why, if you want to use your BTC at any real-world store (supermarkets, gas stations, or standard online shops), the most practical thing is to convert to euros first.

Paying through gift cards and digital vouchers

Another option is to buy gift cards with cryptocurrencies on specialized platforms. You buy an Amazon, Carrefour, Decathlon gift card, etc., using BTC and then use that card in the store as normal. The merchant never sees the crypto part, they only see a normal gift card. It’s very useful for one-off purchases, but it’s not as convenient as having euros directly.

Paying with cryptocurrencies using crypto prepaid cards

With a crypto prepaid card (like Bitsa), you convert your BTC to euros within the app and then pay at any store that accepts Visa or Mastercard. It works just like a debit card: point-of-sale terminals, contactless, online purchases, or ATMs. The difference is you don’t need a bank account and the source of the balance is crypto. It’s the closest thing to using a regular card, but spending your satoshis.

If what you’re looking for is to use Bitcoin without complicating your life, the third option usually wins by a landslide—it lets you pay at 99% of places where only euros exist.

Advantages of a crypto prepaid card

A crypto prepaid card has the advantage of taking away the “circuit” of selling, withdrawing, waiting, and then spending. It’s a daily use solution, not just “whenever I feel like it.”

- You convert and spend in the same flow: top up with crypto → balance in euros → pay.

- You pay at regular stores: supermarket, gas station, Amazon, apps, subscriptions… the usual stuff.

- Spending control: by converting to euros, you reduce the volatility effect for that money you’re going to use.

- Speed: depending on the network and confirmations, it can be much faster.

- One app: balance, transactions, virtual card, online payments… all in the same place.

This is Bitsa’s advantage—you don’t need to sell on an exchange, withdraw to a bank, and then load a card. Everything happens in one movement: you send BTC, it converts to euros, and you can already pay anywhere.

Points to check before choosing a crypto card

Before deciding on a crypto card, it’s worth looking at some basic details. Each card works under different conditions, so you can choose the one that best fits your use.

- Fees and costs: check if there’s a cost for top-up, conversion, ATM withdrawals, or maintenance.

- Applied exchange rate: sometimes there’s no “fee” as such, but there is a margin in the exchange. What matters is the final cost.

- Usage limits: daily or monthly limits for top-up, spending, or withdrawal. For daily use they’re usually sufficient, but it’s good to know them.

- Available cryptocurrencies: which coins it accepts for top-up (BTC, ETH, USDT, etc.) and on which networks.

- Top-up times: some top-ups are almost immediate and others depend on blockchain confirmations.

- Country availability: that it operates where you live and you can use it without friction.

- Virtual card and online payments: useful for online purchases, subscriptions, and quick payments from your phone.

- Support and app: a clear app and decent support make daily use much more comfortable.

With these points, comparison is easy—you choose with criteria and avoid surprises from differences in how services work.

How Bitsa top-up with bitcoin works

Bitsa is a prepaid card. When you top up with Bitcoin, Bitsa generates a unique deposit address for that top-up, and once the transaction is confirmed, the Bitcoin is converted and the equivalent amount in euros is credited to your card.

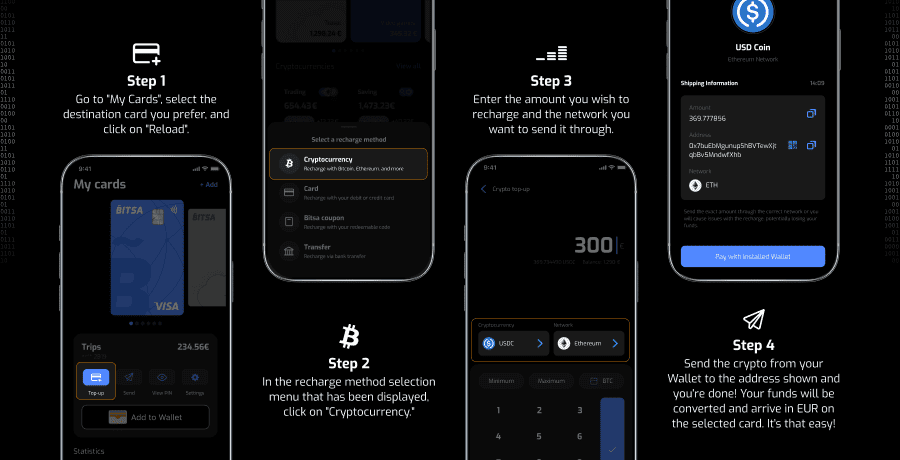

The process is simple:

- Open the Bitsa app and choose “Top up card“

- Select “Cryptocurrency”

- Choose BTC from all available cryptos

- Enter the amount you want to send

- Once the transaction is confirmed on the blockchain, Bitsa automatically converts your crypto to euros

- The euro balance appears in your Bitsa account, ready to spend

⚠️ VERY IMPORTANT: The blockchain network address to send to will change with each transaction. Don’t send top-ups to old addresses.

Once converted, your balance is in euros. It no longer depends on Bitcoin volatility—those euros are yours and you can spend them whenever you want with your card. You’ll be able to use your BTC in your daily life. To pay at the supermarket, subscriptions, online purchases, travel, or any type of transaction you need. There are several ways to convert Bitcoin to euros, each with its advantages and disadvantages. You can sell on an exchange and withdraw to the bank, use BTC ATMs, sell P2P, or use crypto prepaid cards.

The most practical option for spending in your daily life is to convert to euros first and then use a card that works at any store. That way you forget about looking for stores that accept BTC directly. If you want to start using your bitcoins in your daily life, try topping up your Bitsa card with crypto and pay at any store as usual.