Guide: how to avoid scams and fraud in 2026

Our digital lives are growing exponentially: we pay with our phones, shop online, make bank transfers, and manage our finances through mobile apps. This digital transformation, while making our daily lives easier, also expands our exposure to cyber threats. Without proper protection measures, every online transaction becomes a potential entry point for criminals.

The reality is that cybercrimes and scams increase every year. ENISA analyzed 4,875 incidents in the ENISA Threat Landscape 2024. Cybercriminals exploit the immediacy of digital transactions, users’ excessive trust, and increasingly sophisticated techniques to carry out attacks.

At Bitsa, we’ve put together this practical guide to help you identify, prevent, and respond to fraud attempts. We want you to have the tools you need to protect yourself without unnecessary complications.

What are the most common finance-related scams?

As we mentioned, cybercriminals have perfected their attack methods, especially in the financial sector where profits are immediate. Knowing their most common tactics is essential to avoid falling into their traps.

Below, we detail the types of financial fraud causing the most victims right now, how they work, and the warning signs you should watch for to protect your money.

1. Phishing

This is the most common scam used by cybercriminals. It involves fake emails that impersonate real companies. They include logos, email addresses, and a tone very similar to the company they’re trying to replace. Their main goal is to get you to click on a link that takes you to a fake website where you’ll share your account credentials or other personal information.

For example, you might receive an email with the subject line “Your Bitsa account will be blocked if you don’t confirm your details” and a button saying “Verify now.” The page it takes you to looks identical to Bitsa’s, but the URL contains errors or a strange domain.

To prevent it, watch out for:

- Be wary of artificial urgency: Legitimate emails never use alarming language or pressure you to act immediately. Bitsa will never contact you with threatening messages or ones that create panic.

- Always verify the sender: Official Bitsa emails come exclusively from verified domains like soporte@bitsacard.com. Any variation or similar domain is a clear sign of fraud.

- Never use links from suspicious emails: Always access your account directly from the official app or by manually typing our URL into your browser. Links can redirect you to fraudulent sites identical to the original.

Important information: Bitsa will never ask for your credentials, passwords, or codes via email.

2. Smishing

Smishing is a fraud technique that uses SMS text messages or WhatsApp to deceive victims. Criminals impersonate trusted entities using fake or spoofed numbers, sending messages with malicious links.

The strategy is always the same: create artificial urgency through threats or false alerts—account suspension, unrecognized charges, expiring prizes—so you act impulsively without analyzing the situation. The ultimate goal is to steal your credentials or install malware on your device when you click the provided link.

An example might be: “Your Bitsa account has been suspended for security reasons. Click the following link to reactivate it.” The link takes you to a fake website that tries to steal your data or install malware on your device.

To prevent:

- Never open links included in SMS or WhatsApp messages, even if they seem legitimate.

- Messages sent by banks and financial institutions like Bitsa don’t include links asking for your personal information.

- If in doubt, go directly to the app or contact the support team through official channels and ask about your case.

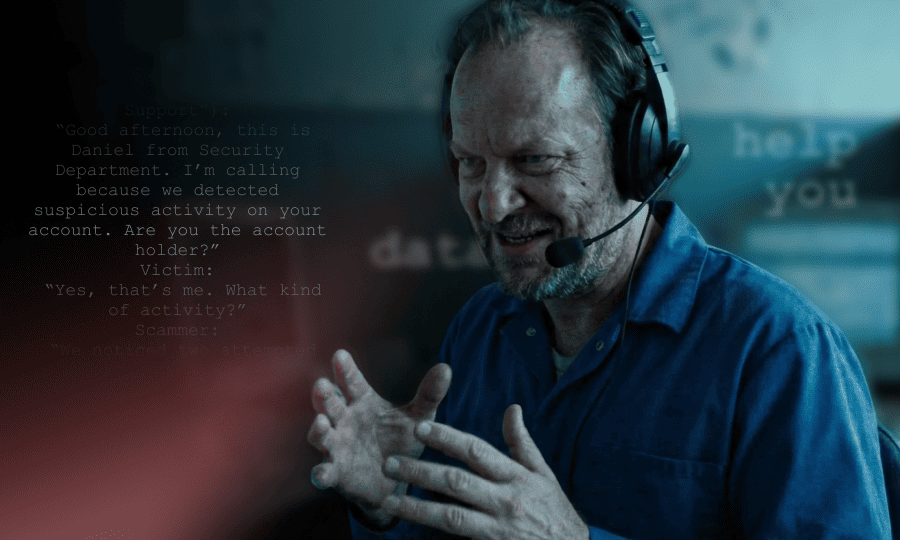

3. Vishing

Vishing is phone fraud where criminals pose as representatives from your bank, service companies, or even police authorities. During the call, they create an emergency scenario: unauthorized charges, suspicious access or legal problems requiring immediate action. Their goal is to manipulate you into revealing confidential information while you’re under pressure.

You receive a call from a supposed “Bitsa security agent” alerting you about fraudulent movements in your account. To “protect you,” they request your passwords or verification code. The moment you provide this information, the scammers gain full access to your account and can empty it in seconds.

Tips to avoid it:

- Be wary of any call asking for personal information, codes, or passwords.

- If in doubt, hang up and contact official support yourself through the app or website.

- No Bitsa employee will ever ask for your passwords or verification codes, by any means or for any reason.

4. Online shopping fraud

Online shopping is increasingly common, which is why scammers pay close attention here. They create fake websites that look like real stores or post ads on social media with incredible deals: iPhones for €200, Nike sneakers for €15, designer bags at 80% off.

What happens when you buy from these sites? You lose the money you paid, never receive the product, and criminals keep your card details to make more charges or sell them to others.

How to detect these sites:

- Always check that the website has an SSL padlock (https://) and clear contact information.

- Watch for strange details, such as excessively low prices or insecure payment methods.

- Use virtual cards like Bitsa to limit risk at new or unknown stores.

5. Tech support scams

Scammers pose as the support team to steal your login credentials. They usually call saying there’s a serious problem with your account: a hack, suspicious charges, or that they need to verify your identity urgently. During the call, they directly ask for your passwords, PIN, or verification codes “to fix it.”

Another common variant, after calling to create alarm, they send you an email with a link to a page identical to Bitsa’s. When you enter your details on that fake website, you’re giving them directly to the criminals.

They might also ask you to install remote access applications (TeamViewer, AnyDesk) to “help you.” If you give them access, they can see everything you do: your SMS codes, banking notifications, and approve transfers while watching your screen.

What to do if they contact us:

- Bitsa will NEVER call asking for passwords or codes. If someone does, hang up immediately and contact the support team right away.

- Don’t click on links in emails or messages after a suspicious call. Always enter directly from your Bitsa app or from Bitsa’s official website (bitsacard.com).

- Never share your screen or install programs requested over the phone.

- If in doubt, contact official support yourself through verified channels in the app.

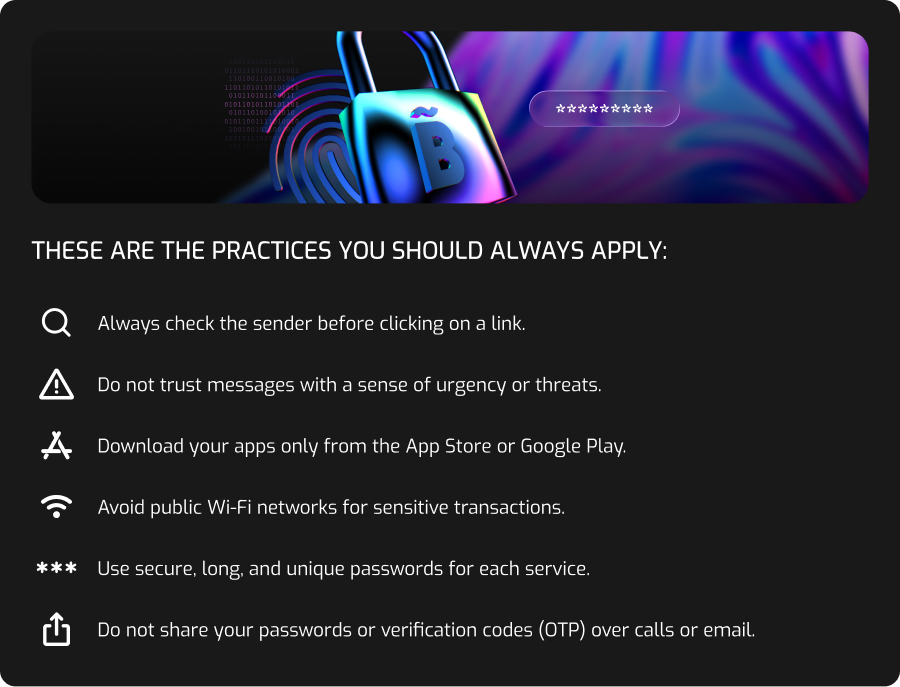

How to protect yourself daily

The best defense against fraud is knowing how to identify warning signs. If you apply these basic security measures, it will be very difficult for scammers to get your data or money.

What to do if you think you’ve fallen for a scam?

If you suspect you’ve been the victim of a scam or have shared sensitive information, acting quickly is crucial.

- Immediately block your cards using your Bitsa app.

- Contact official support through the Help Center.

- Change your passwords and review your recent transactions.

- Don’t delete fake messages or emails. Any evidence can help you.

- Report the fraud to the relevant authorities:

- Europol – will direct you to the fraud reporting page for your country.

-

-

Bitsa’s official channels

Maintaining your security also means knowing how to identify legitimate contact channels. Bitsa will never ask for personal information outside our official channels.

This means we will never contact you via WhatsApp, Telegram, or direct messages on social media.

Important ⚠️

Remember that Bitsa doesn’t have any web dashboard. You must always access your account through the mobile apps for iOS or Android.

Scammers improve their techniques every day, but they have a weak point: they need you to make the mistake. They need you to click, to share your data, to act without thinking.

With this guide, you have everything you need to beat them. Now you know how to recognize their tricks, you know the warning signs, and you have the tools to protect yourself. The difference between being a victim and being protected lies in applying what you’ve learned.

Remember the golden rule: if they pressure you, it’s a scam. If you’re in doubt, stop and verify. And if you need help, Bitsa’s real team will always be available through official channels.

Your money, your data, your security. Don’t give them to anyone.