Open interest in XRP futures grows 32% in April

Despite a brief drop to $1.61 on April 7, 2025, Ripple (XRP) has shown a remarkable recovery in recent weeks, driven by the overall rebound of the cryptocurrency market and a significant increase in Open Interest (OI).

In the current cryptocurrency market landscape, XRP’s Open Interest (OI) has recorded a marginal increase of 0.32% in the last 24 hours, reaching $3.65 billion. This slight rise in OI suggests a modest strengthening of confidence and liquidity within XRP’s derivatives market.

However, it is crucial to highlight the significant 17% contraction in trading volume, which stands at $3.9 billion. This decline in transactional activity raises questions about the underlying conviction of traders, who appear to be waiting for a more defined directional signal in XRP’s price trajectory before committing capital more substantially.

The divergence between a slightly rising OI and decreasing volume could be interpreted as a period of consolidation and indecision in the market, where participants assess the asset’s future prospects before taking firm positions.

32% Increase in XRP Futures Open Interest in April 2025

OI, a crucial metric for evaluating market trends and the strength behind price movements, revealed a 32% increase in XRP futures between April 21 and 23, reaching $4.13 billion. This surge signals strong bullish sentiment and the return of derivatives traders to the XRP market.

Key Catalysts of Open Interest

- XRP Futures on the CME: The announcement by the Chicago Mercantile Exchange (CME)about the launch of XRP futures on May 19 has generated significant interest. This offering will allow investors to capitalize on XRP’s volatility without needing to own the asset directly. Contracts will be available in macro (50,000 XRP) and micro (2,500 XRP).

As a result, Brad Garlinghouse, CEO of Ripple Labs, described this move as “an incredibly important and exciting step in the continued growth of the XRP market.”

- Potential ProShares XRP ETF: The S. Securities and Exchange Commission (SEC)is considering the approval of an XRP ETF backed by ProShares Trust, with a decision expected by June 17. The approval of this ETF would mark a significant milestone in the evolution of crypto ETFs and could have a considerable impact on Ripple’s token liquidity.

https://x.com/EleanorTerrett/status/1917262100419731541?t=gpgbXPJMRRhDkyGDBDTrEQ&s=35

Market Dynamics and Future Outlook

XRP’s current price is $2.12, up 2% over the past 24 hours after news of potential US-China trade talks shifted investor sentiment. It also has a market cap of $124.92 billion and a 24-hour trading volume of $3.79 billion.

All of this is supported by an increase in the number of new addresses created for the altcoin, reaching a two-week high of 3,677 addresses on April 28, according to Glassnode data. The Relative Strength Index (RSI) also confirms this bullish trend.

However, despite growing interest in futures, the data suggests that XRP’s price is caught in a battle between bullish spot market activity and bearish perpetual futures.

Long-Term Technical Projections

- Sistine Research: Forecasts a long-term target between 33and33and50, based on a symmetrical triangle patternreminiscent of the 2,600% rally in 2017.

https://x.com/sistineresearch/status/1914756845740184025 - CoinCodex: Estimates that XRP’s average pricecould reach $2.97, with the highest growth expected in the first half of the year.

- DigitalCoinPrice: He predicts the average price could exceed $3.40 by the end of 2025 and reach $5.11 by early 2026.

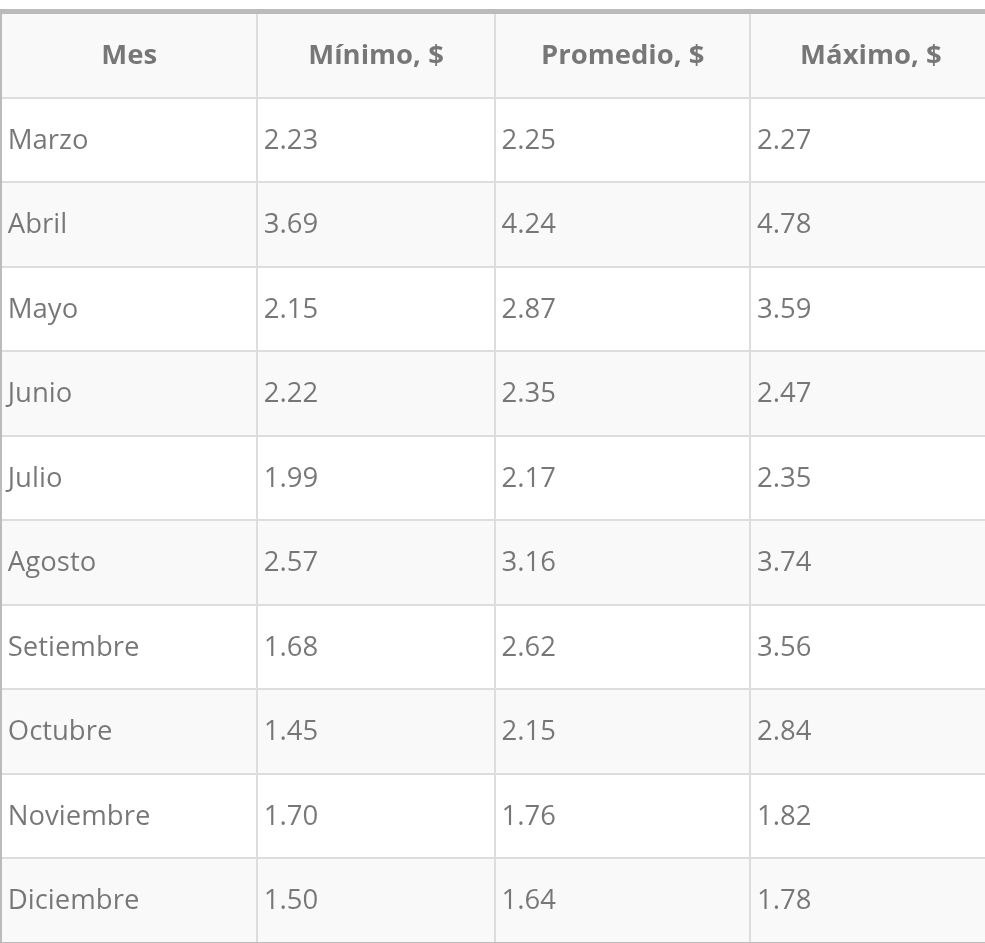

- Changelly: Anticipates pronounced volatility for XRP in 2025.

Conclusions: An Active Market with Mixed Signals

The XRP market shows considerable activity, driven by the launch of CME futures and the potential approval of a ProShares ETF.

While the increase in Open Interest suggests greater market commitment, there are mixed signals due to a notable number of short positions. XRP’s price currently reflects a struggle between bullish spot market sentiment and bearish futures sentiment, creating a mixed outlook for XRP’s near future. So before making decisions, let’s heed Warren Buffett’s advice: “Never invest in a business you cannot understand.”