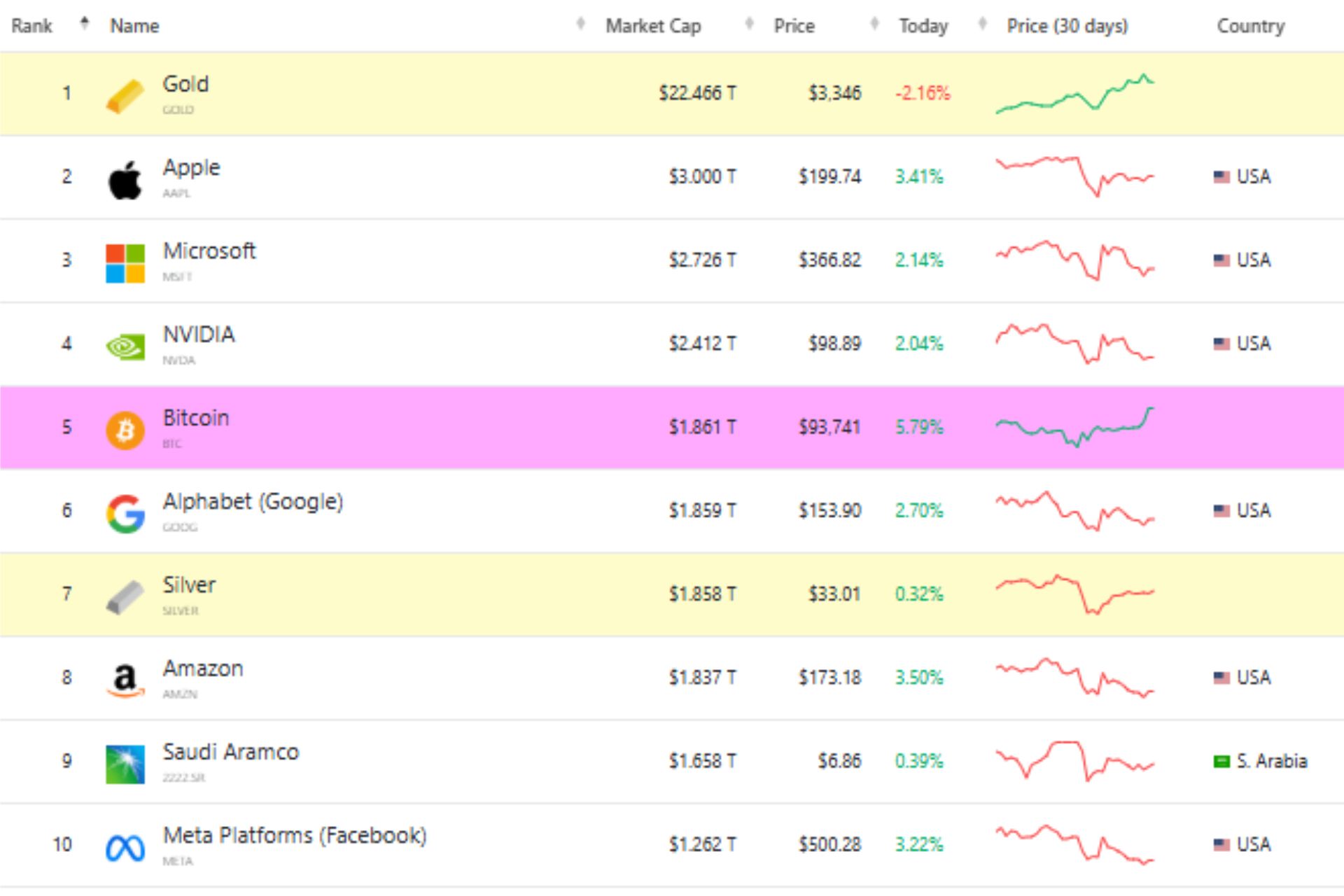

Bitcoin Surpasses Amazon in Market Capitalization

On May 22, a milestone in the history of Bitcoin took place as it managed to surpass Amazon in market capitalization. On that day, the market value of Bitcoin reached $2.19 trillion, surpassing Amazon, which stood at $2.13 trillion.

This event positioned Bitcoin as the fifth most valuable asset in the world, behind giants like Apple, Microsoft, and Nvidia. It is worth noting that the increase in its value coincided with the Bitcoin Pizza Day. This day commemorates how, on the same date in 2010, the first purchase using Bitcoin as a means of payment was made.

CoinMarketCap showed in its real-time data how the total cryptocurrency market capitalization reached more than $3.49 trillion. Although there are many bullish events, you should know that this is not the highest the crypto market has ever reached.

Who is involved?

This historic moment involves several players from both the financial and technological ecosystems. Bitcoin is the pioneering and most recognized cryptocurrency worldwide. Its recent price increases are due both to the actions of individual investors and to the consolidation it has been gaining in recent months, managing to surpass not only Amazon, but also other tech giants like Meta or assets like silver.

This milestone is considered so important, since Amazon is a renowned tech giant and pioneer in e-commerce and technology. That Bitcoin has managed to surpass this giant in capitalization highlights how decentralized assets are managing to compete against the traditional.

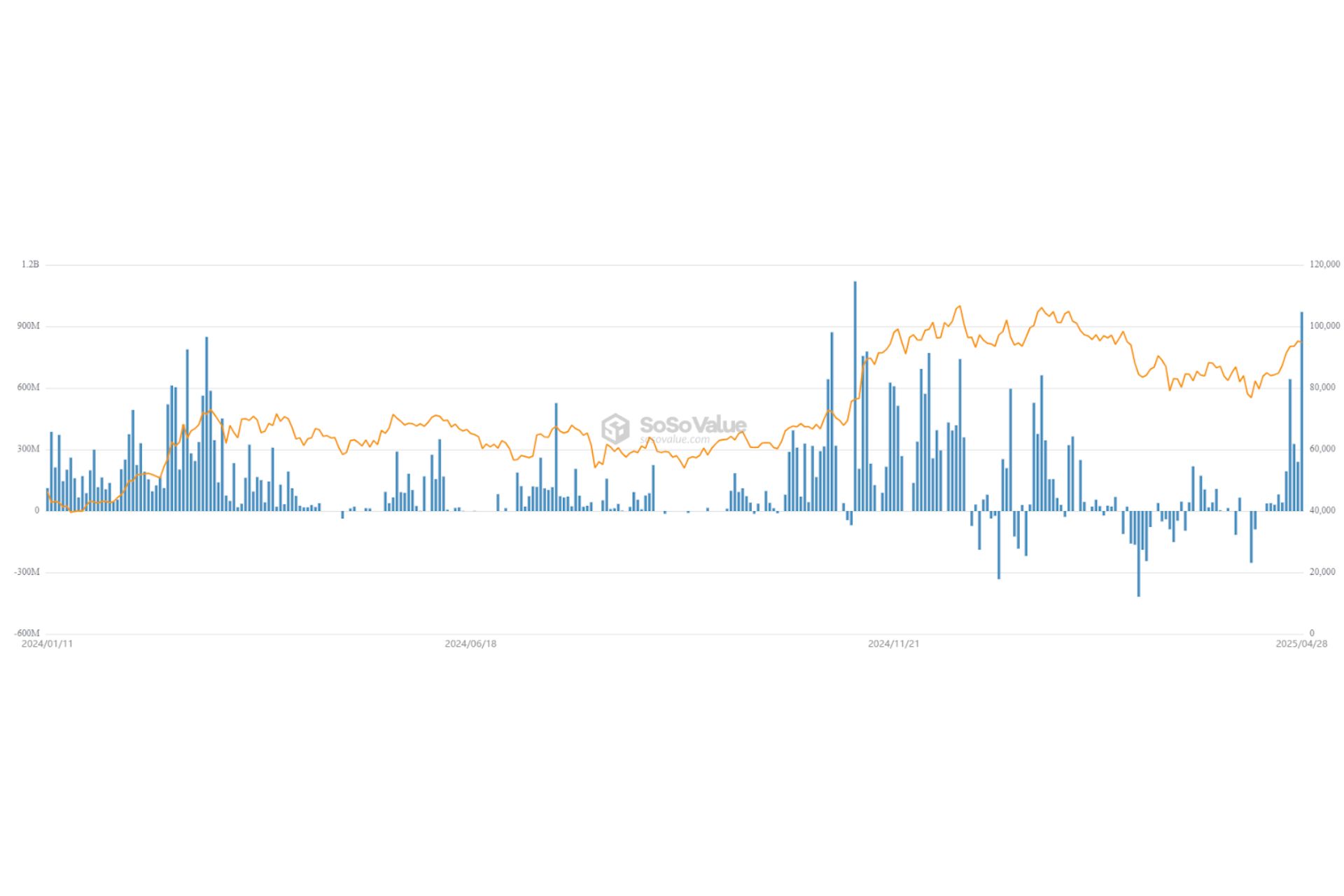

The recent momentum of Bitcoin is not by chance and is largely due to the massive entry of institutional investors. Numerous companies, such as BlackRock, have become users of this cryptocurrency. In fact, as reported by Cointelegraph, BlackRock’s Bitcoin ETF acquired nearly $1 billion in BTC on April 28.

Retail investors, for their part, have also participated in this event, as market sentiment is bullish these days. Mostly, this is due to factors such as the search for alternatives to inflation or safe havens in the unstable environment resulting from the new tariffs imposed by the United States.

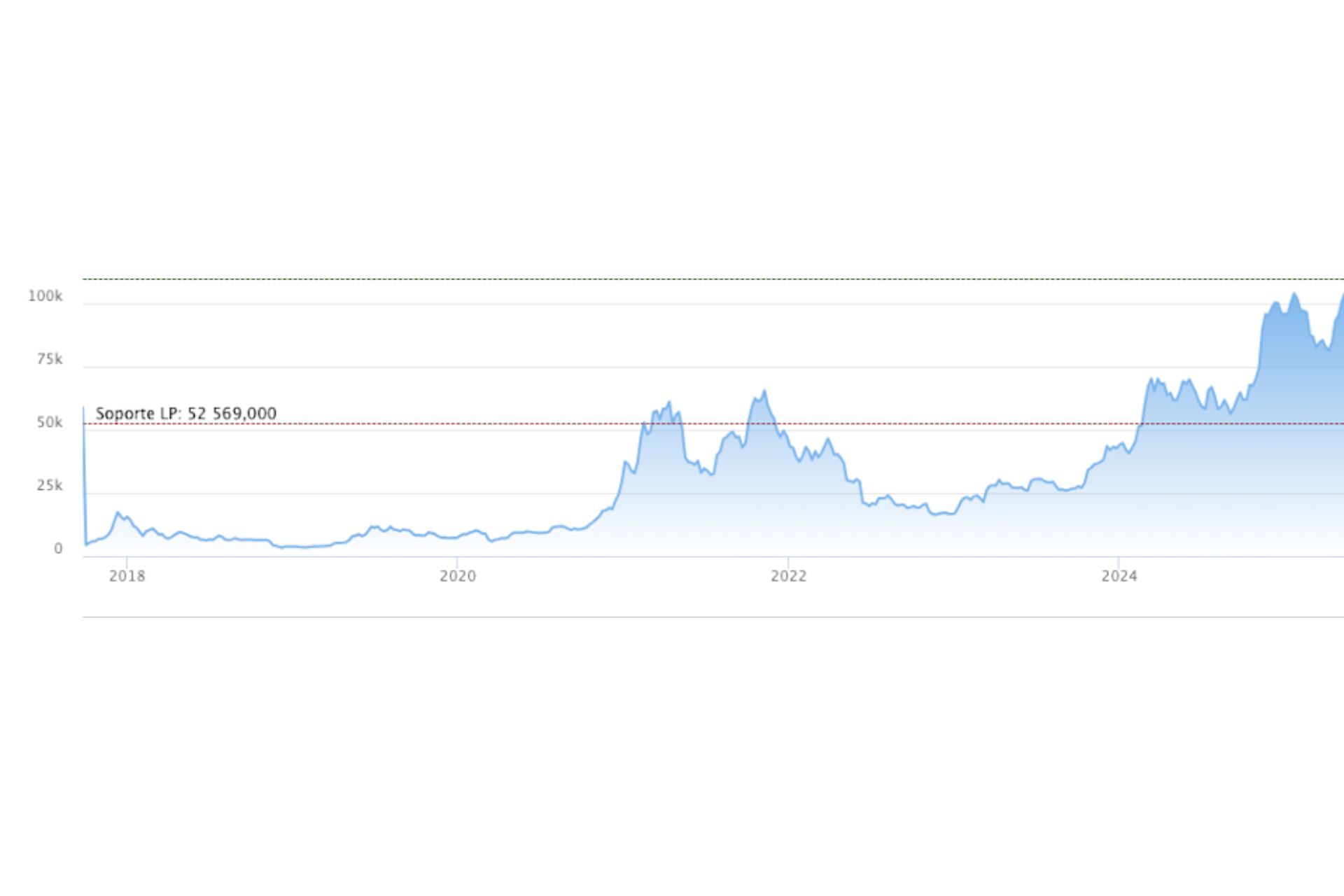

Reactions on social media to the current rally have also been key to taking Bitcoin to these new levels. Voices in the crypto world, such as trader Titan of Crypto, noted that they expected increases of up to $135,000 for this year based on their analysis with tools such as key resistance and support levels or Fibonacci.

#Bitcoin $135,000 Target Still in Play for 2025 🚀

The plan is unfolding perfectly.

We kept stacking #BTC when everyone was panicking and got plenty of hate for it.

Imagine still being on the sidelines now… 👀 pic.twitter.com/ry1XeGVsg2

— Titan of Crypto (@Washigorira) May 21, 2025

The event did not go unnoticed, and social networks were filled with reactions to the unexpected competition between both assets. X was one of the leading platforms for so many celebrations. Users and analysts shared charts and comments celebrating both the Bitcoin Pizza Day and the surpassing of Amazon.

JUST IN: Bitcoin overtakes Amazon and Google to become the 5th biggest asset in the world. pic.twitter.com/dYqKvTTAEK

— Bitcoin Archive (@BTC_Archive) May 21, 2025

When did it happen?

This milestone, as we know, took place on May 22, 2025, when Bitcoin reached a value of $2.19 trillion and Amazon was at $2.13 trillion. The event occurred in a context of all-time highs, with Bitcoin being worth more than $110,000 per BTC. As it surpassed Amazon, Bitcoin consolidated itself as the fifth most valuable asset in the world.

It is doubly important, since it coincided with the Bitcoin Pizza Day. This day is so special because in 2010 the first documented purchase with Bitcoin was made. And as expected, the purchase was for pizzas. There were two, to be exact, for a total value of 10,000 BTC.

That day not only marked the first documented purchase with Bitcoin, but also the purchase of the most expensive pizzas in the world. Although at that time their value was barely $41, today those pizzas would be worth at least $1 billion.

The Bitcoin Pizza Day represents much more than a funny anecdote (although not so much for the buyer). This day represents the first real use case of Bitcoin and how it went from being a digital rarity to becoming a digital means of payment. Since that day, every May 22 this milestone is celebrated with events, marketing campaigns, and discounts.

For this reason, the fact that it coincided with Bitcoin surpassing Amazon in market capitalization caused such a stir in the crypto ecosystem. These milestones reinforced the historic nature of that date and how Bitcoin started as a payment for two pizzas, but now leads the tech giant Amazon.

Where does it have an impact?

The impact of Bitcoin surpassing Amazon was notable and multidimensional, especially in three key aspects:

- Traditional financial markets: By consolidating itself as the fifth most valuable asset in the world, Bitcoin shook the markets with the idea of when it will climb the next steps. Coverage was not only in crypto media, but the news also reached economic and financial portals.

- Confidence and capital inflow: The fact that a cryptocurrency has surpassed an established global company increased confidence in this asset and in the crypto market in general. At the same time, on May 22, TradingView data reported an increase in inflows into Bitcoin exchange-traded funds (ETF) of nearly $604 million on May 21.

- Market reaction: On this day, while Bitcoin hit its new all-time high above $110,000, Amazon slowly retreated. This caused an increase in capital flow towards Bitcoin. Also, this month BlackRock became the second largest bitcoin holder below Satoshi Nakamoto.

This news became the subject of massive coverage by financial media and users. In this way, confidence and institutional investments in Bitcoin as an asset increased significantly. That same day, Bitcoin accumulated a 3.3% rise and an appreciation of nearly 17% so far in 2025 and 120% in 2024.

Why is it important? (Why)

It goes without saying that this milestone is of great importance in the history of the crypto ecosystem. Mostly, this importance is due to the fact that Bitcoin, a completely decentralized asset, has surpassed Amazon in market capitalization. This affects numerous dimensions both financial, technological, and cultural, marking a before and after in market history.

By surpassing Amazon, Bitcoin positioned itself as the fifth most valuable asset in the world, with only gold and the three largest companies ahead. The simple fact that an open and decentralized protocol can not only compete, but surpass centralized giants, demonstrates that the value of something is no longer just in a good centralized and traditional structure, but can also be found in the trust of a distributed, intermediary-free network.

On the other hand, this event has meant a clear increase in confidence in Bitcoin as a global asset, not only among crypto users, but also among large funds and institutional participants such as BlackRock.

For new users and emerging markets, the idea that Bitcoin can be a store of value and a financial tool, even in times of monetary instability, is reinforced.

How has it been achieved?

Surpassing Amazon is not an easy task nor something that can be achieved in two days. To achieve it, numerous previous events had to occur that allowed Bitcoin to reach where it is now:

- Institutional adoption and capital flows: In the first months of this year, capital inflows into BTC have been historic thanks to U.S. ETFs and institutional adoption by companies such as Microstrategy or BlackRock.

- 2024 Halving: This halving halved the mining reward for new bitcoins, which caused upward pressure on the price by limiting the available supply. It is worth noting that historically, halving events have preceded bullish cycles, and 2025 is another of these cases.

- Macroeconomic factors: The market operates according to the events that occur in it and this has been a very significant year. From global economic uncertainty and inflation, to the monetary policies of the U.S. Federal Reserve and negotiations with China. All this causes clear distrust in FIAT money and leads users to seek alternatives to protect their assets, such as Bitcoin.

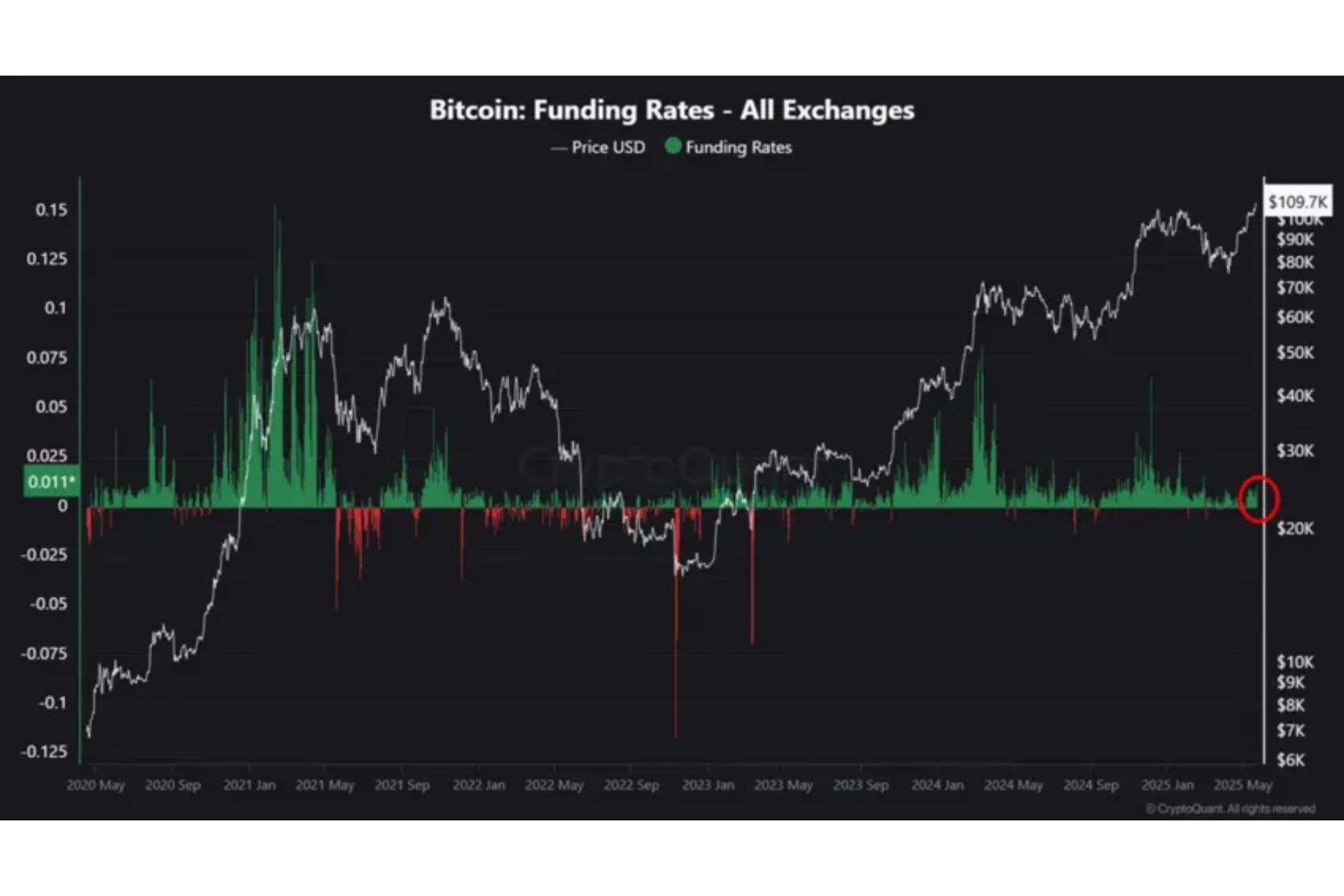

- Less speculative market: Unlike previous bullish cycles, this 2025 rally is accompanied by less speculation and greater participation in BTC perpetual futures. According to data provided by CryptoQuant, in the peak of March and December 2024, the funding rate for futures skyrocketed. This indicated positions that were too long and an overheated market. However, in May 2025, the funding rate has remained low compared to other peaks.

Bitcoin funding rate. Source: CryptoQuant

In summary, the achievement of Bitcoin surpassing Amazon marks a before and after not only in the history of this cryptocurrency, but of the entire blockchain ecosystem. It means a great advance for decentralization and increased confidence in this sector.

More and more people are deciding to familiarize themselves with the crypto ecosystem and events like this increase those entries. That is why platforms like Bitnovo exist, where buying, selling, and exchanging cryptocurrencies is intuitive and accessible. In this way, both experienced users and those taking their first steps can learn.